How The 10 Worst Solution Fails Of All Time Could Have Been Prevented

5 Easy Facts About Invoicing Features Described

Table of ContentsInvoicing Features Can Be Fun For EveryoneThe smart Trick of Mobile Invoice Maker App That Nobody is DiscussingThe Definitive Guide for Invoice MakerCreate Invoices Things To Know Before You Buy6 Easy Facts About Types Of Invoices DescribedMobile Invoice Maker App Things To Know Before You Get This

https://www.youtube.com/embed/Jhi0n4mjbkM

Billings are a main component to the SimplePractice billing system. Producing a billing is the primary step for billing your clients. These files indicate when there is a balance due for a customer - laying out the quantity they owe for product or services rendered. This guide covers how invoices will be used for optimized financial management, giving you the tools you require to quickly track customer balances.

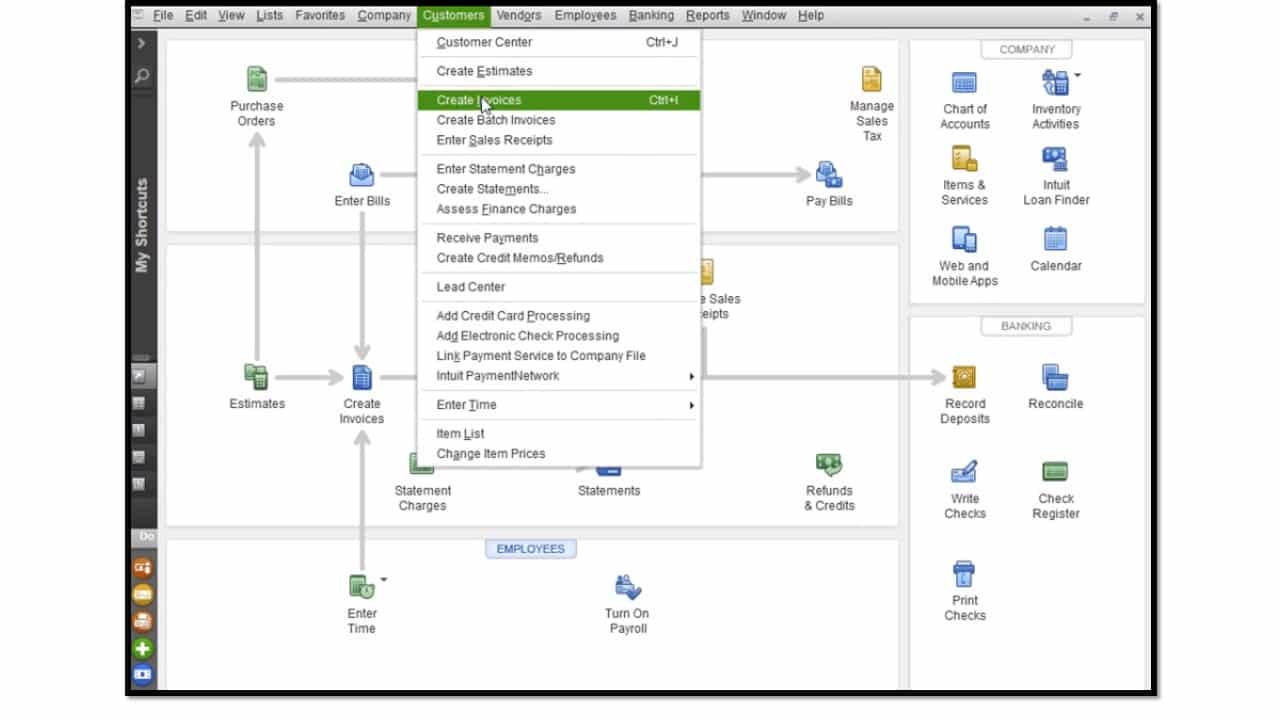

There are several methods to produce invoices. SimplePractice gives you the versatility to handle these processes instantly or manage them by hand as required. By default, invoices are set to automatically create daily. With this setting, a billing will be created overnight if a client has been seen for an appointment.

You likewise have the option to manually generate billings or set them to auto-generate on a monthly basis. We recommend that these options are just used for practices with complicated billing workflows. You can work with among our Customer Success team to identify if either of these alternatives are needed for your practice.

The Facts About Invoice Maker Uncovered

The Best Strategy To Use For Detailed Invoice

The Best Strategy To Use For Detailed Invoice

Once a billing is generated, the quantity transfers to the, offering a record of what your client owes. You can manage your invoice generation settings by going to. From here you can pick the choice that is best for your practice: Automatically produce billings at the end of each day.

Do not automate billings. (Just recommended for practices with intricate billing workflows) If you collect payment and record it at the time of an appointment, you will include a payment and produce a billing at the very same time from the Calendar Fly-out. To do this, choose the right consultation in the calendar.

The invoice is produced and the payment applied. You'll get confirmation of this with the invoice suggested on the flyout. If you 'd choose to see and personalize the invoice before applying payment, you can click instead of. If you by hand develop billings for a consultation, the system will not create another duplicate billing for that appointment, even with automatic invoicing established for your practice.

The Best Guide To Detailed Invoice

If you see either a or a quantity reflected when it must not be, this suggests that you'll want to upgrade their financial records. Browse to the client's page Click Click in the pop-up that follows Your invoice will appear with all exceptional appointments noted and you can modify it as required.

See How are payments designated to billings? to discover how your customer's payments are published to invoices. If your customers have cost modification billings, it means that the visit cost has actually been changed for an appointment that was already invoiced. If a consultation cost changes, the system needs to produce a modification invoice to balance out the modification.

Some Known Questions About Mobile Invoice Maker App.

Some Known Questions About Mobile Invoice Maker App.

Edit the appointment cost, if you have not done so already. If you've currently modified the visit cost, skip to step 3. Produce new invoices for the appointment and ensure to modify the date before conserving the billing. You can edit the date on a newly produced billing by clicking the date on the billing.

Some Ideas on Detailed Invoice You Should Know

We suggest billing automation due to the fact that invoices are the basis of billing in SimplePractice. If you disable invoice automation, you will need to by hand invoice appointments for each client. In your Billing and Solutions settings, you can indicate when an invoice is considered overdue. This will assist you remain up to date with your billing and identify which invoices require your attention the a lot of.

The Facts About Types Of Invoices Revealed

The Facts About Types Of Invoices Revealed

There isn't a way to avoid the system from showing invoices after they've been provided for a specific variety of days as overdue. As soon as 30 days google docs have passed considering that a billing was created, if it stays unsettled, the status will alter to You can sneak peek and customize the past due email template by navigating to > > >.

See Including a payment to discover how to include a client payment. are non-appointment items you can contribute to invoices to charge a client. It can consist of anything from books, workshops, service charges, an initial balance, and so on. To find out more about establishing your product list, refer to. You can add a product as a line item to any unpaid billing.

The Of Invoice Generator

The Only Guide for Create Invoices

The Only Guide for Create Invoices

Open the overdue invoice. Click. If the invoice is already marked as paid, you can erase it and recreate a brand-new one. New invoices can be edited prior to they're conserved. Describe to get more information. Click for the product you desire to add. You can include as lots of as you need.

After the product has been contributed to the invoice, you can make edits to the quantity or description as needed. The invoice is now prepared to be paid. If you need to make any modifications, you can click again at the leading right corner as long as the billing remains in the status.

9 Simple Techniques For Invoice Maker

9 Simple Techniques For Invoice Maker

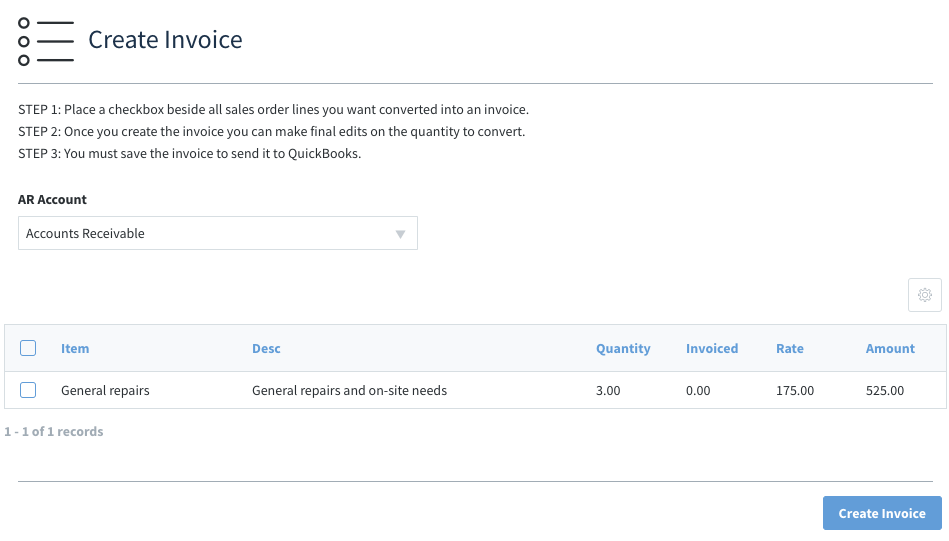

These billable, non-appointment products are employed SimplePractice. In these cases, you can produce stand-alone billings to charge your customer for Products just. To read more about how to include billable Products to your account, see Including an item. Navigate to the client's page. Click >. Click. You will just see the popup if all existing appointments are already invoiced.

9 Simple Techniques For Invoicing Features

To learn how to develop a new billing for consultations, see Developing invoices. Click. Click for each Product you want to contribute to the invoice. Click the when you're done. After the Product has actually been included to the billing, you can make edits to the quantity or description as required.

This is why we have actually given you multiple alternatives for how services display on invoices. To choose how you wish to show this details by default, follow these actions: Go to Under choose either Use Usage Consultation Service and Description By default, billings will display all visit types as when the invoice is produced.

From Around The Web: 20 Awesome Photos Of Subscription-based

The Greatest Guide To Mobile Invoice Maker App

Table of ContentsThe 10-Second Trick For Invoicing FeaturesThe Ultimate Guide To Create InvoicesThe 15-Second Trick For Detailed Invoice4 Simple Techniques For Mobile Invoice Maker AppThe Best Strategy To Use For Create InvoicesSome Known Incorrect Statements About Invoice Generator

https://www.youtube.com/embed/T8aBRacVyGI

Invoices are a main part to the SimplePractice billing system. Developing a billing is the first step for billing your clients. These files show when there is a balance due for a client - outlining the quantity they owe for product or services rendered. This guide covers how invoices will be used for optimized monetary management, giving you the tools you need to easily track customer balances.

There are numerous methods to develop billings. SimplePractice offers you the versatility to deal with these processes instantly or manage them by hand as needed. By default, billings are set to immediately produce on a daily basis. With this setting, a billing will be produced overnight if a customer has been seen for a consultation.

You likewise have the alternative to manually create invoices or set them to auto-generate on a regular monthly basis. We advise that these options are just used for practices with complicated billing workflows. You can deal with one of our Client Success group to identify if either of these choices are needed for your practice.

Not known Details About Types Of Invoices

Invoice Maker for Dummies

Invoice Maker for Dummies

As soon as a billing is generated, the amount transfers to the, giving a record of what your customer owes. You can manage your billing generation settings by going to. From here you can pick the option that is ideal for your practice: Automatically develop billings at the end of each day.

Do not automate invoices. (Only suggested for practices with complex billing workflows) If you gather payment and record it at the time of a visit, you will add a payment and produce an invoice at the same time from the Calendar Fly-out. To do this, pick the correct appointment in the calendar.

The billing is created and the payment applied. You'll receive verification of this with the invoice showed on the flyout. If you 'd prefer to view and tailor the invoice prior to using payment, you can click instead of. If you by hand create billings for a visit, the system will not produce another duplicate billing for that consultation, even with automated invoicing set up for your practice.

The Basic Principles Of Invoicing Features

If you see either a or an amount showed when it ought to not be, this indicates that you'll desire to upgrade their monetary records. Browse to the customer's page Click Click in the pop-up that follows Your billing will appear with all impressive visits listed and you can edit it as required.

See How are payments allocated to billings? to find out about how your client's payments are published to invoices. If your clients have charge adjustment billings, it suggests that the appointment charge has been altered for an appointment that was already invoiced. If a visit cost changes, the system needs to develop an adjustment billing to cancel the change.

How Types Of Invoices can Save You Time, Stress, and Money.

How Types Of Invoices can Save You Time, Stress, and Money.

Modify the consultation charge, if you haven't done so already. If you've already modified the consultation charge, skip to step 3. Develop brand-new billings for the visit and make certain to modify the date prior to saving the billing. You can modify the date on a freshly developed billing by clicking the date on the billing.

The 7-Second Trick For Detailed Invoice

We recommend billing automation since invoices are the basis of billing in SimplePractice. If you disable billing automation, you will require to by hand invoice appointments for each client. In your Billing and Solutions settings, you can indicate when an invoice is thought about past due. This will assist you stay up to date with your billing and recognize which billings need your attention the many.

Some Known Incorrect Statements About Detailed Invoice

Some Known Incorrect Statements About Detailed Invoice

There isn't a way to prevent the system from suggesting invoices after they pdf have actually been released for a specific variety of days as unpaid. As soon as 30 days have actually passed given that a billing was created, if it remains overdue, the status will alter to You can preview and tailor the past due e-mail design template by navigating to > > >.

See Including a payment to find out how to include a customer payment. are non-appointment items you can include to billings to charge a client. It can include anything from books, workshops, service fee, an initial balance, etc. To read more about setting up your product list, refer to. You can include a product as a line product to any overdue invoice.

The Types Of Invoices Statements

The Only Guide to Invoicing Features

The Only Guide to Invoicing Features

Open the overdue invoice. Click. If the billing is already marked as paid, you can erase it and recreate a brand-new one. New billings can be edited before they're saved. Refer to for more information. Click for the item you desire to add. You can add as numerous as you require.

After the item has been added to the billing, you can make edits to the quantity or description as needed. The invoice is now prepared to be paid. If you require to make any changes, you can click again on top right corner as long as the billing remains in the status.

Some Known Details About Types Of Invoices

Some Known Details About Types Of Invoices

These billable, non-appointment products are called in SimplePractice. In these cases, you can develop stand-alone invoices to charge your client for Products only. To discover more about how to add billable Products to your account, see Including a product. Navigate to the client's page. Click >. Click. You will only see the popup if all existing consultations are currently invoiced.

Mobile Invoice Maker App - Questions

To discover how to produce a brand-new billing for appointments, see Producing billings. Click. Click for each Product you want to include to the billing. Click the when you're done. After the Item has actually been included to the invoice, you can make edits to the amount or description as required.

This is why we've given you several options for how services show on invoices. To select how you would like to display this info by default, follow these actions: Go to Under choose either Usage Use Appointment Service and Description By default, billings will display all consultation types as when the billing is produced.

30 Of The Punniest Microsoft Excel Puns You Can Find

Not known Facts About Types Of Invoices

Table of ContentsSome Known Incorrect Statements About Mobile Invoice Maker App Everything about Types Of InvoicesSome Of Types Of InvoicesThe Ultimate Guide To Types Of InvoicesExcitement About Types Of InvoicesTypes Of Invoices Can Be Fun For Everyone

https://www.youtube.com/embed/PNfU4N7WHs0

Invoices are a central element to the SimplePractice billing system. Developing a billing is the initial step for billing your customers. These files show when there is a balance due for a customer - outlining the amount they owe for product or services rendered. This guide covers how invoices will be utilized for optimized monetary management, providing you the tools you require to quickly track client balances.

There are a number of methods to create invoices. SimplePractice gives you the versatility to deal with these processes instantly or manage them manually as required. By default, billings are set to immediately produce daily. With this setting, a billing will be developed over night if a customer has actually been seen for a consultation.

You also have the option to manually produce invoices or set them to auto-generate on a monthly basis. We advise that these choices are only utilized for practices with complex billing workflows. You can work with one of our Client Success group to identify if either of these alternatives are required for your practice.

10 Simple Techniques For Create Invoices

Invoice Generator Can Be Fun For Anyone

Invoice Generator Can Be Fun For Anyone

When a billing is produced, the quantity transfers to the, giving a record of what your client owes. You can manage your billing generation settings by going to. From here you can pick the choice that is right for your practice: Instantly develop invoices at the end of each day.

Do not automate invoices. (Only suggested for practices with intricate billing workflows) If you collect payment and record it at the time of a consultation, you will include a payment and produce an invoice at the very same time from the Calendar Fly-out. To do this, select the appropriate appointment in the calendar.

The billing is generated and the payment used. You'll receive verification of this with the invoice suggested on the flyout. If you 'd choose to view and tailor the billing before applying payment, you can click rather of. If you manually develop invoices for an appointment, the system will not produce another duplicate billing for that consultation, even with automated invoicing established for your practice.

9 Easy Facts About Detailed Invoice Shown

If you see either a or an amount reflected when it needs to not be, this implies that you'll desire to update their financial records. Navigate to the client's page Click Click in the pop-up that follows Your billing will appear with all outstanding visits noted and you can modify it as needed.

See How are payments google play assigned to invoices? to find out about how your client's payments are published to billings. If your customers have charge change billings, it indicates that the appointment cost has actually been changed for an appointment that was already invoiced. If a visit cost modifications, the system needs to produce a change invoice to stabilize out the modification.

The Ultimate Guide To Mobile Invoice Maker App

The Ultimate Guide To Mobile Invoice Maker App

Modify the visit fee, if you haven't done so already. If you have actually already edited the appointment fee, avoid to step 3. Create new invoices for the visit and make sure to edit the date before conserving the billing. You can edit the date on a newly produced billing by clicking the date on the billing.

Facts About Detailed Invoice Revealed

We suggest invoice automation because billings are the basis of billing in SimplePractice. If you disable billing automation, you will need to by hand invoice appointments for each client. In your Billing and Services settings, you can suggest when an invoice is thought about overdue. This will assist you keep up to date with your billing and identify which invoices need your attention the most.

Invoice Maker Things To Know Before You Buy

Invoice Maker Things To Know Before You Buy

There isn't a method to avoid the system from showing invoices after they have actually been issued for a particular number of days as overdue. When 30 days have passed given that an invoice was developed, if it remains unsettled, the status will change to You can sneak peek and personalize the past due e-mail template by navigating to > > >.

See Adding a payment to find out how to add a client payment. are non-appointment items you can add to invoices to charge a client. It can include anything from books, workshops, service charges, an initial balance, and so on. To find out more about establishing your product list, describe. You can include an item as a line product to any unsettled invoice.

Not known Facts About Types Of Invoices

The Single Strategy To Use For Detailed Invoice

The Single Strategy To Use For Detailed Invoice

Open the unsettled invoice. Click. If the billing is already marked as paid, you can delete it and recreate a brand-new one. New billings can be modified before they're saved. Refer to to discover more. Click for the product you wish to add. You can add as lots of as you need.

After the product has actually been included to the billing, you can make edits to the quantity or description as needed. The invoice is now all set to be paid. If you require to make any modifications, you can click again at the leading right corner as long as the billing remains in the status.

Invoicing Features - The Facts

Invoicing Features - The Facts

These billable, non-appointment items are hired SimplePractice. In these cases, you can create stand-alone invoices to charge your customer for Products just. To get more information about how to add billable Products to your account, see Adding an item. Browse to the customer's page. Click >. Click. You will only see the popup if all existing consultations are currently invoiced.

Some Known Questions About Invoice Generator.

To learn how to produce a brand-new invoice for appointments, see Producing invoices. Click. Click for each Item you wish to contribute to the billing. Click the when you're done. After the Item has actually been contributed to the billing, you can make edits to the quantity or description as needed.

This is why we have actually offered you multiple alternatives for how services display on invoices. To choose how you wish to display this details by default, follow these actions: Go to Under choose either Use Usage Visit Service and Description By default, invoices will show all appointment types as when the billing is created.

12 Helpful Tips For Doing Receipt

subscription-based style="clear:both" id="content-section-0">Not known Factual Statements About Create Invoices

Table of ContentsInvoicing Features Can Be Fun For EveryoneThe Best Guide To Invoicing FeaturesAn Unbiased View of Create InvoicesMore About Invoice MakerAn Unbiased View of Invoicing FeaturesThe Ultimate Guide To Invoice Generator

https://www.youtube.com/embed/QXzUG9hqg_0

Invoices are a central element to the SimplePractice billing system. Developing a billing is the very first action for billing your customers. These files indicate when there is a balance due for a customer - outlining the quantity they owe for product or services rendered. This guide covers how invoices will be utilized for enhanced monetary management, offering you the tools you require to easily track customer balances.

There are several methods to produce billings. SimplePractice provides you the flexibility to manage these procedures automatically or manage them by hand as required. By default, invoices are set to instantly generate on a daily basis. With this setting, an invoice will be created over night if a customer has actually been seen for a visit.

You also have the choice to manually produce billings or set them to auto-generate on a month-to-month basis. We advise that these choices are only used for practices with intricate billing workflows. You can deal with one of our Customer Success group to figure out if either of these alternatives are required for your practice.

Get This Report about Mobile Invoice Maker App

10 Simple Techniques For Mobile Invoice Maker App

10 Simple Techniques For Mobile Invoice Maker App

When an invoice is produced, the quantity transfers to the, giving a record of what your client owes. You can handle your billing generation settings by going to. From here you can choose the choice that is best for your practice: Automatically develop invoices at the end of every day.

Do not automate invoices. (Just advised for practices with complex billing workflows) If you collect payment and record it at the time of a visit, you will add a payment and produce an invoice at the same time from the Calendar Fly-out. To do this, pick the appropriate visit in the calendar.

The invoice is generated and the payment applied. You'll receive verification of this with the invoice indicated on the flyout. If you 'd prefer to view and tailor the invoice prior to using payment, you can click instead of. If you by hand produce invoices for a consultation, the system will not create another duplicate billing for that appointment, even with automatic invoicing set up for your practice.

Detailed Invoice Can Be Fun For Everyone

If you see either a or an amount reflected when it ought to not be, this indicates that you'll wish to update their financial records. Browse to the client's page Click Click in the pop-up that follows Your invoice will appear with all impressive appointments noted and you can edit it as needed.

See How are payments designated to invoices? to learn about how your customer's payments are published to invoices. If your customers have cost adjustment billings, it implies that the visit cost has been changed for a visit that was currently invoiced. If an appointment fee changes, the system requires to develop an adjustment invoice to balance out the change.

Invoicing Features Can Be Fun For Everyone

Invoicing Features Can Be Fun For Everyone

Edit the consultation fee, if you haven't done so currently. If you've already edited the visit charge, avoid to step 3. Develop brand-new billings for the visit and make sure to modify the date prior to saving the billing. You can modify the date on a newly developed billing by clicking the date on the billing.

Invoice Generator Things To Know Before You Get This

We suggest billing automation since invoices are the basis of billing in SimplePractice. If you disable billing automation, you will require to by hand invoice visits for each client. In your Billing and Providers settings, you can suggest when a billing is considered past due. This will help you remain up to date with your billing and determine which billings need your attention the a lot of.

Our Create Invoices Ideas

Our Create Invoices Ideas

There isn't a way to avoid the system from indicating billings after they've been issued for a particular variety of days as past due. When one month have actually passed because an invoice was developed, if it stays overdue, the status will change to You can preview and personalize the past due email template by browsing to > > >.

See Adding a payment to find out how to add a client payment. are non-appointment items you can contribute to billings to charge a customer. It can include anything from books, workshops, service charges, a preliminary balance, and so on. To find out more about setting up your item list, refer to. You can add a product as a line product to any unpaid billing.

Not known Facts About Mobile Invoice Maker App

The Main Principles Of Invoice Generator

The Main Principles Of Invoice Generator

Open the overdue billing. Click. If the invoice is currently marked as paid, you can delete it and recreate a brand-new one. New invoices can be edited prior to they're conserved. Refer to to read more. Click for the product you want to add. You can add as numerous as you need.

After the product has been included to the invoice, you can make edits to the quantity or description as required. The billing is now prepared to be paid. If you require to make any changes, you can click once again at the leading right corner as long as the invoice remains in the status.

The Buzz on Types Of Invoices

The Buzz on Types Of Invoices

These billable, non-appointment products are employed SimplePractice. In these cases, you can develop stand-alone billings to charge your client for Products only. To get more information about how to add billable Products to your account, see Adding a product. Browse to the client's page. Click >. Click. You will only see the popup if all existing appointments are currently invoiced.

The Of Create Invoices

To discover how to develop a brand-new billing for visits, see Creating billings. Click. Click for each Product you wish to contribute to the billing. Click the when you're done. After the Product has been contributed to the invoice, you can make edits to the quantity or description as required.

This is why we've provided you multiple alternatives for how services show on invoices. To choose how you would like to display this details by default, follow these actions: Go to Under select either Use Usage Visit Service and Description By default, billings will show all visit types as when the invoice is created.

15 Hilarious Videos About Spark Invoice Maker

What Does Types Of Invoices Do?

Table of ContentsFacts About Types Of Invoices RevealedDetailed Invoice Fundamentals ExplainedThe smart Trick of Invoice Maker That Nobody is Discussing4 Easy Facts About Invoice Maker DescribedTypes Of Invoices Things To Know Before You Get This

The Basic Principles Of Types Of Invoices

The Basic Principles Of Types Of Invoices

https://www.youtube.com/embed/qoWRMSvsc0s

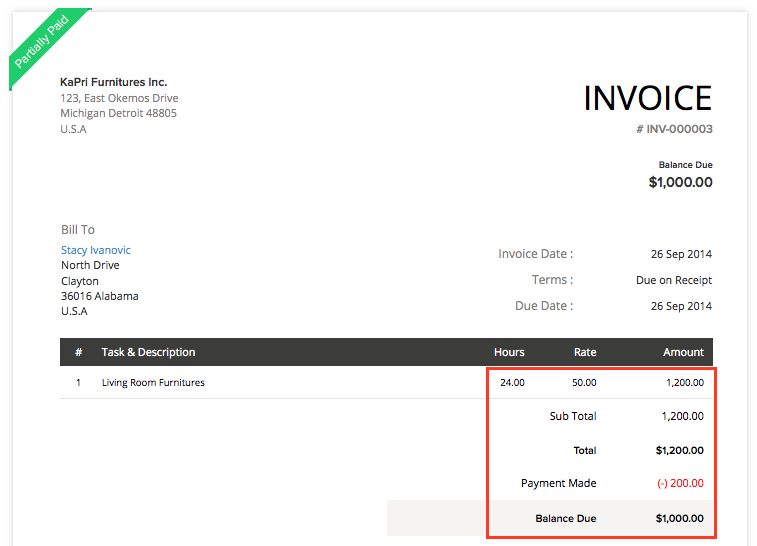

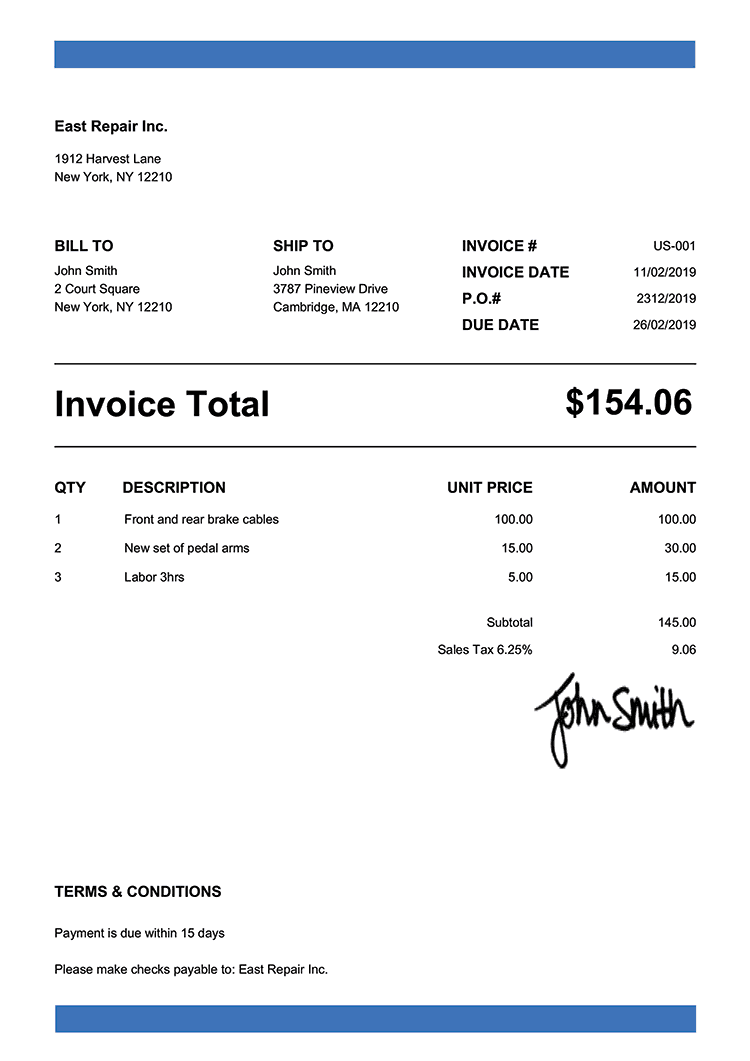

Invoices can be deleted at any time! Here's how: Click the invoice to see it. Once the billing is open, you'll see three buttons at the top of the screen: and, as revealed listed below. Click. Deleted invoices and other deleted files can not be obtained. Make sure to download the file as a PDF prior to deleting if you desire to keep it for your records.

They can stay in the system to show you've billed the client. If billings aren't created for a session, the session fee will not be part of the client's balance and payments will lead to a credit balance. Yes, in order to use the billing features of SimplePractice, you'll require to use invoices.

Lots of SimplePractice consumers would like to add sales tax to their billings. While this is something that our program can not presently calculate instantly, you can produce a Sales Tax "Product" which can be included to any invoice. First, go to and include a brand-new product for Sales Tax with a description that works for you.

The Greatest Guide To Types Of Invoices

Now return to your client's profile and produce an Invoice. Click to personalize the invoice and the button to enter your sales tax line item. Click to include the Sales Tax Product you produced. Then click to return to the invoice. Next, compute and go into the suitable quantity of the sales tax based upon the charge in the submitted and click at the top of the billing.

Some customers decide to pass along the charge card processing charges to clients their customers. In some states this practice is illegal, so verify the laws that govern card acceptance in your state before you include costs to your credit billings. Here is how to include the processing cost to a client billing: That's it! Now your billing includes a credit card processing cost.

You can access and make a copy of it from here: Clients often ask us for advice about the legality of this practice (i. e., passing credit card costs on to customers). The very best way to get an answer to this concern is to ask a legal representative. Nevertheless, we can supply some information that is widely offered on this concern.

Invoice Maker for Dummies

Please keep in mind that this is basic details only and we do not mean for you to utilize any of it as legal suggestions or guidance. Nor do we mean for you to use it in lieu of looking for proper legal counsel. If you set the customer's appointment charge incorrectly or you decide to alter the fee for your client, you may need to delete and recreate billings for these consultations.

The billing will show $100 due for the appointment. However, what if you suggested to charge the client $80 for this consultation? If you modify the visit fee and change it to $80, the invoice won't immediately change to $100. The system thinks you are making a change so it produces a change billing with a $20 credit.

These additional invoices can be confusing if you didn't indicate to bill that way. Let's stroll through the appropriate steps, which will leave you with a cleaner billing page. For the appointment that isn't billed properly you can choose one of two options:. You are fixing the invoice since it shows the inaccurate fee and you only plan to bill the client $80 (this is the most typical scenario): Browse to the customer's billing overview page, and click the billing noted next to the consultation in the visit line and click in the leading right corner.

6 Simple Techniques For Detailed Invoice

Click under the appointment cost. Update the consultation charge (from $100 to $80). Click. Then create a new billing for the client. You wish to develop a change invoice and you do not wish to erase the initial invoice. In this case, you can modify the consultation cost and let the system develop the modification invoice.

Click under the visit cost. Go into the updated appointment charge and click. The system will immediately produce a change invoice. If you have invoices set to be produced instantly, this change invoice will be produced overnight. Otherwise, you can produce it manually by clicking from the upper right corner of the customer's profile.

We recommend keeping billings automation on Daily in order to prevent any billing confusion. Just ensure to make any session cost changes before completion of the day so invoices create correctly.

The Main Principles Of Invoicing Features

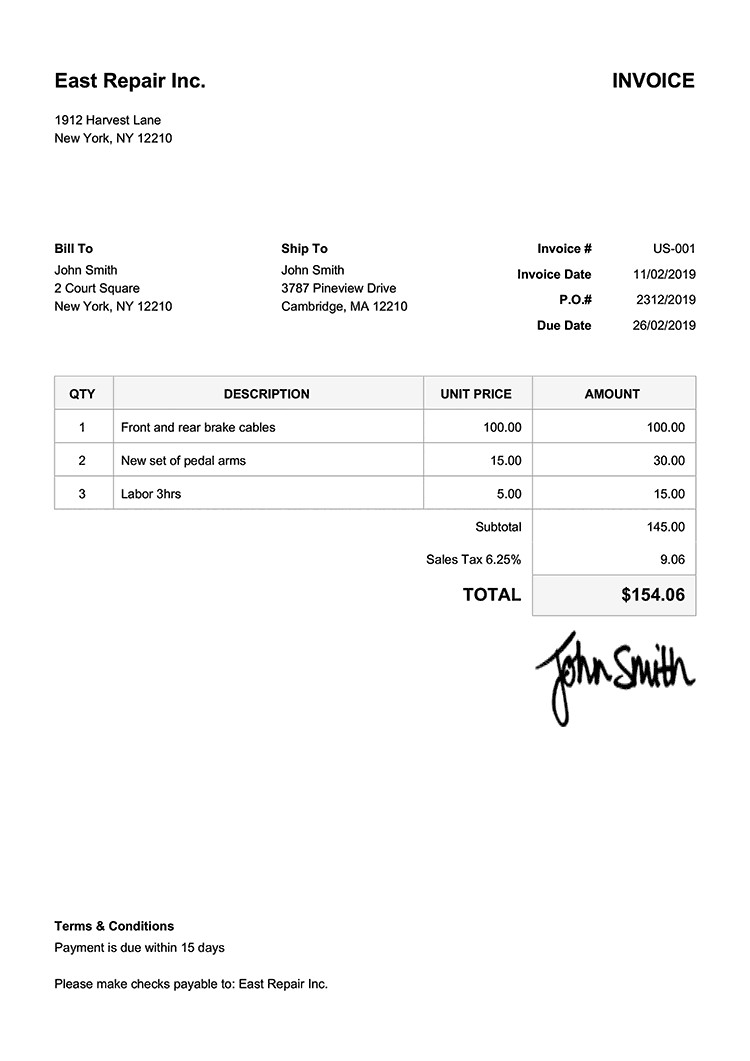

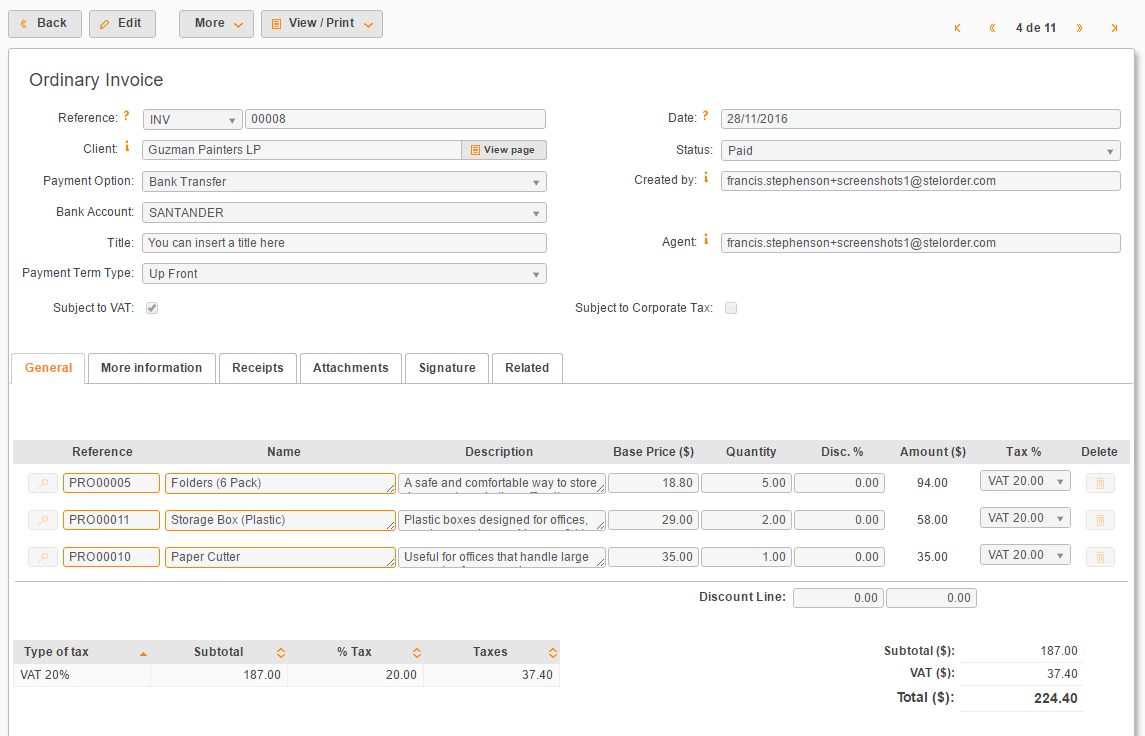

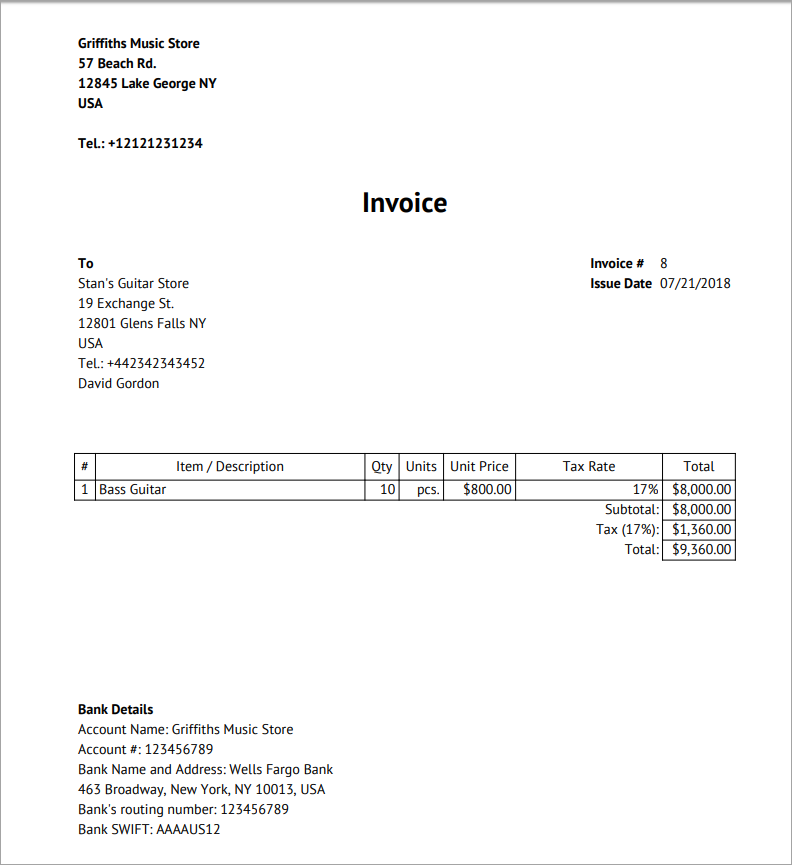

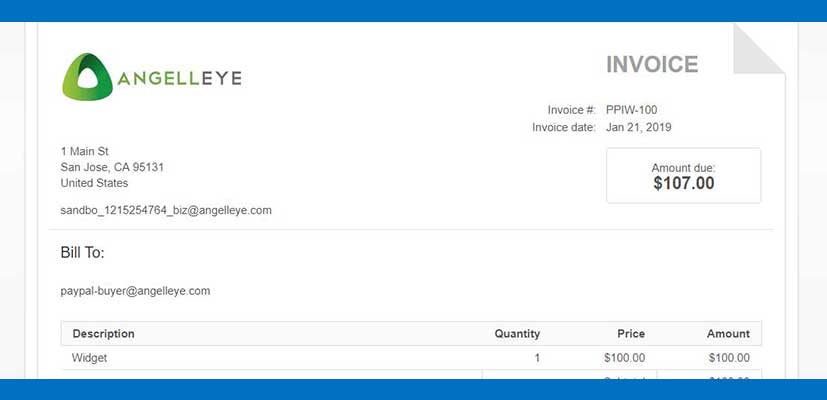

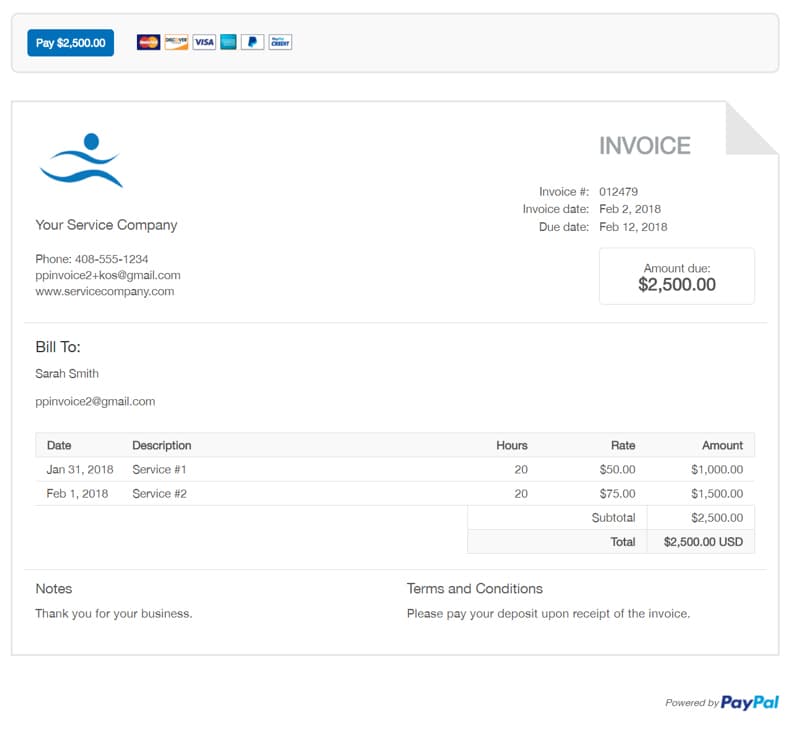

You've done the work; now it's payment time. Here's where your billing plays a crucial role. Let's walk through the process of making a billing. Prior to drawing up an invoice, make sure your consumer is anticipating one. If your invoice comes out of nowhere, they may be sluggish to pay it, or even annoyed.

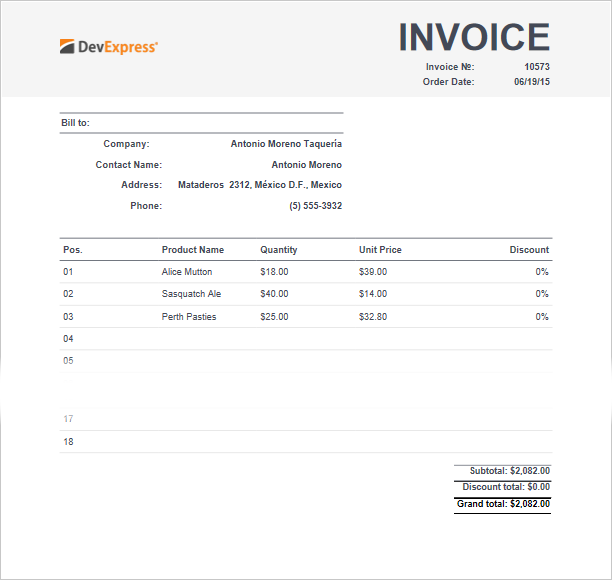

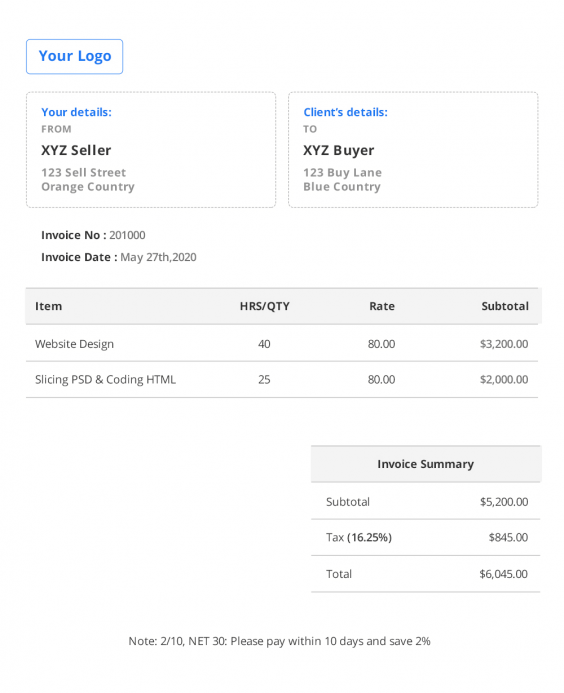

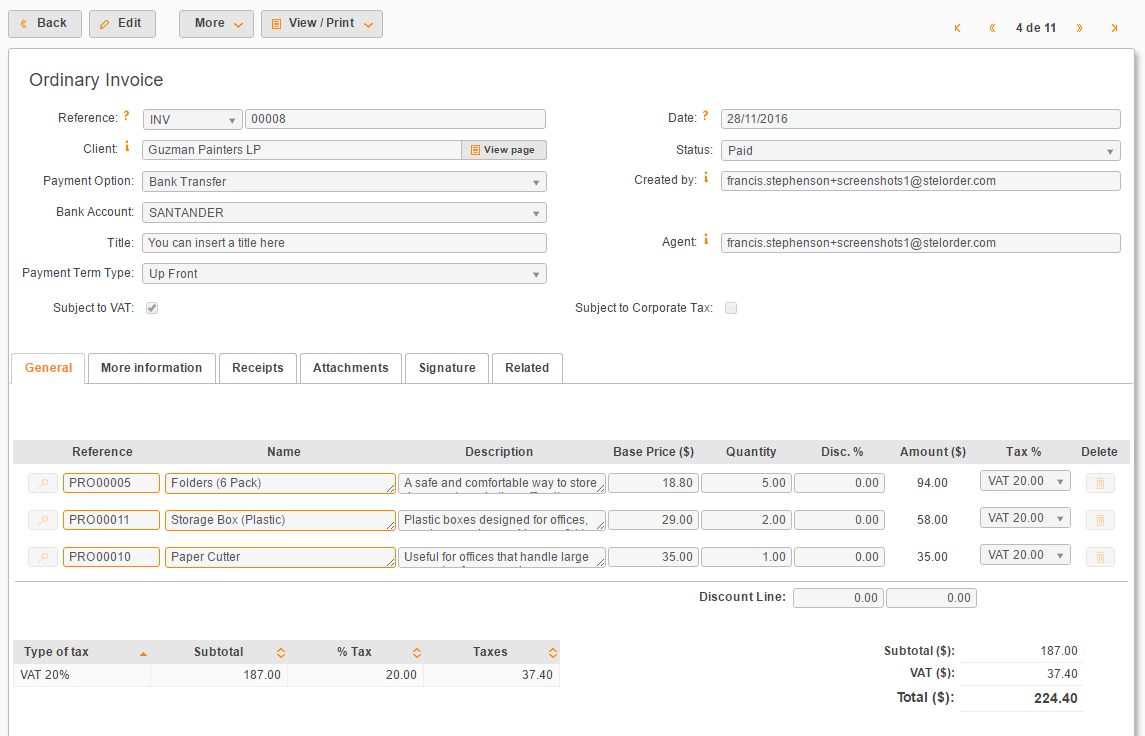

If you don't have a contract in location, a minimum of tell them when an invoice is about to be raised. You require to show the seller, the buyer, and what was exchanged. You may also be required to reveal if you gathered tax on the sale. Some of the information, such as your service name, will remain the same from one billing to the next.

Indicators on Mobile Invoice Maker App You Need To Know

Indicators on Mobile Invoice Maker App You Need To Know

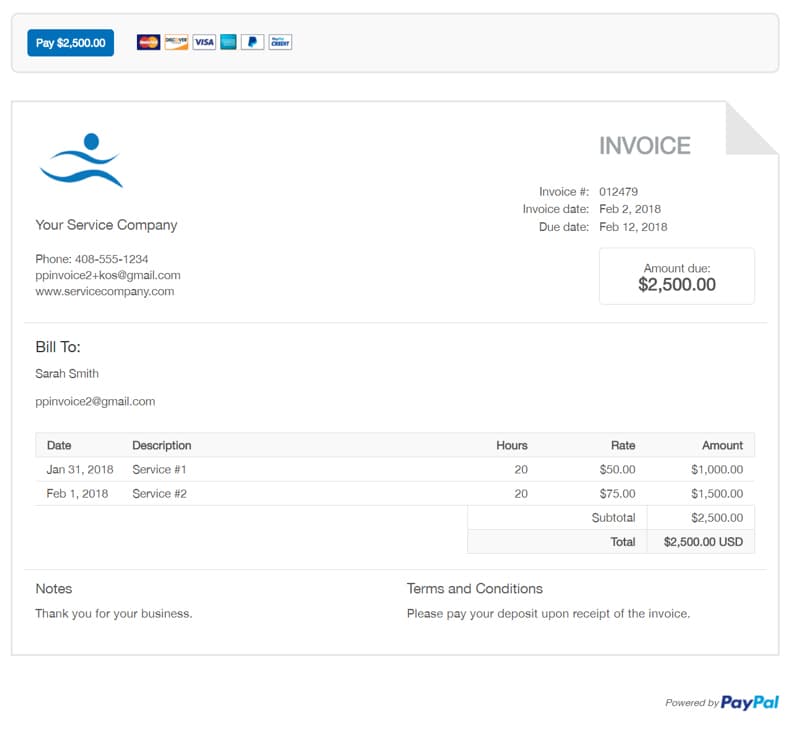

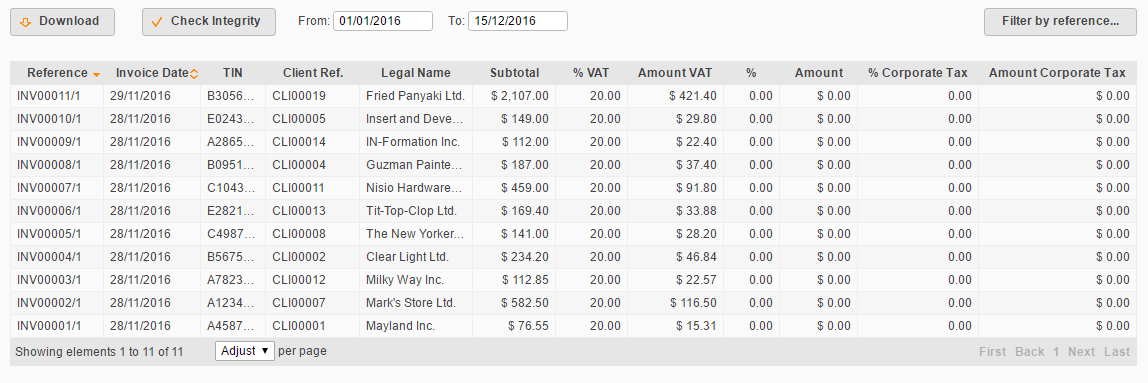

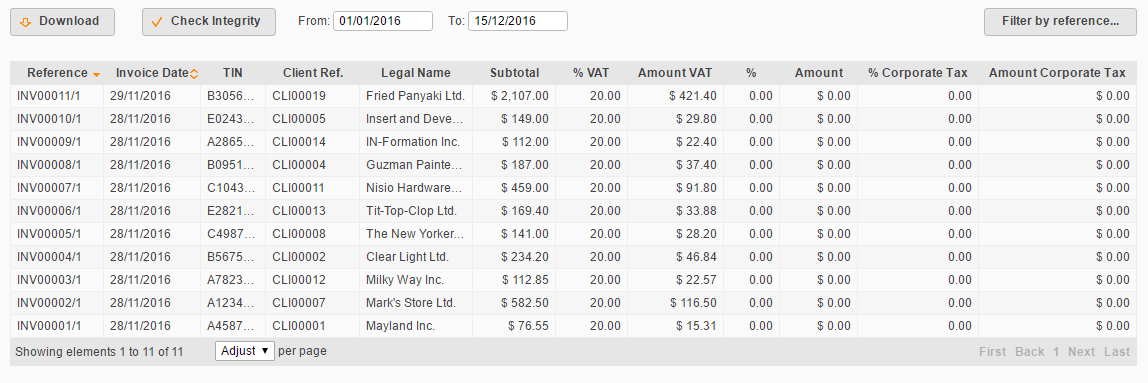

You need to have a distinct invoice number on every costs you send out. This is to help you, the consumer, or possibly auditors to locate particular invoices. A billing number can be any string of numbers and letters. You can use various methods to produce an invoice number, such as: numbering your invoices sequentially, for example INV00001, INV00002 starting with an unique customer code, for example XER00001 consisting of the date at the start of your invoice number, for instance 2019-01-001 combining the customer code and date, for example XER-2019-01-001 Your numbering system can help you arrange and search for previous invoices quickly.

12 Companies Leading The Way In Oberlo

language id="content-section-0">Detailed Invoice Things To Know Before You Buy

Table of ContentsThe smart Trick of Mobile Invoice Maker App That Nobody is Talking About

7 Easy Facts About Mobile Invoice Maker App Described

7 Easy Facts About Mobile Invoice Maker App Described

What Does Invoice Generator Mean?

What Does Invoice Generator Mean?

https://www.youtube.com/embed/Jhi0n4mjbkM

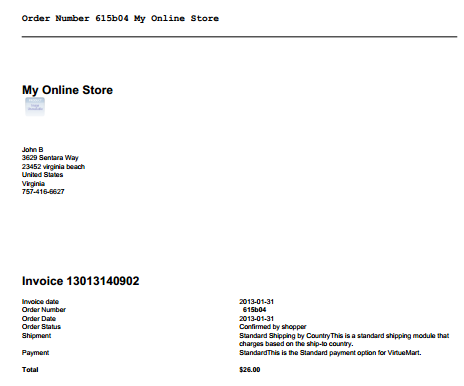

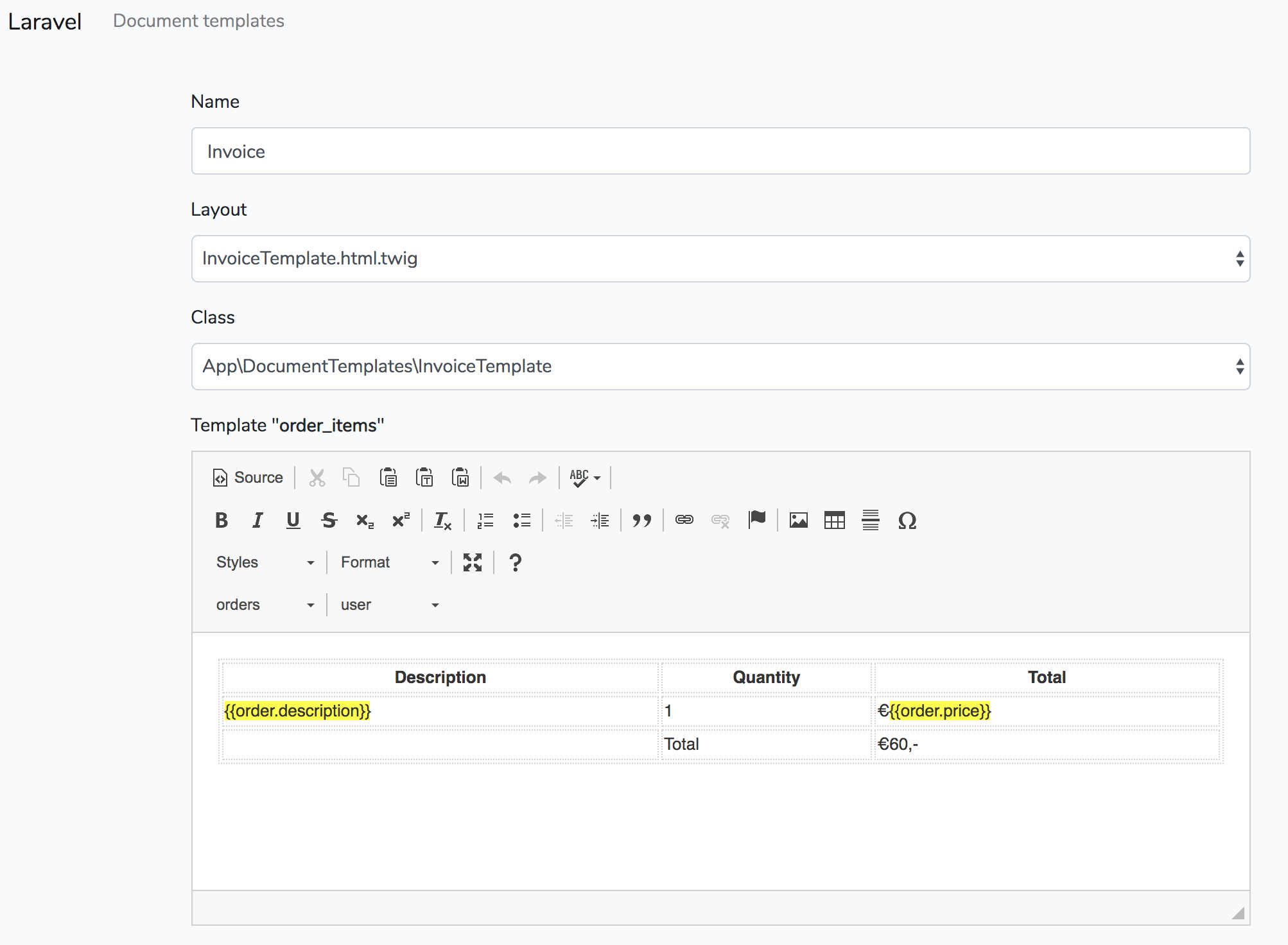

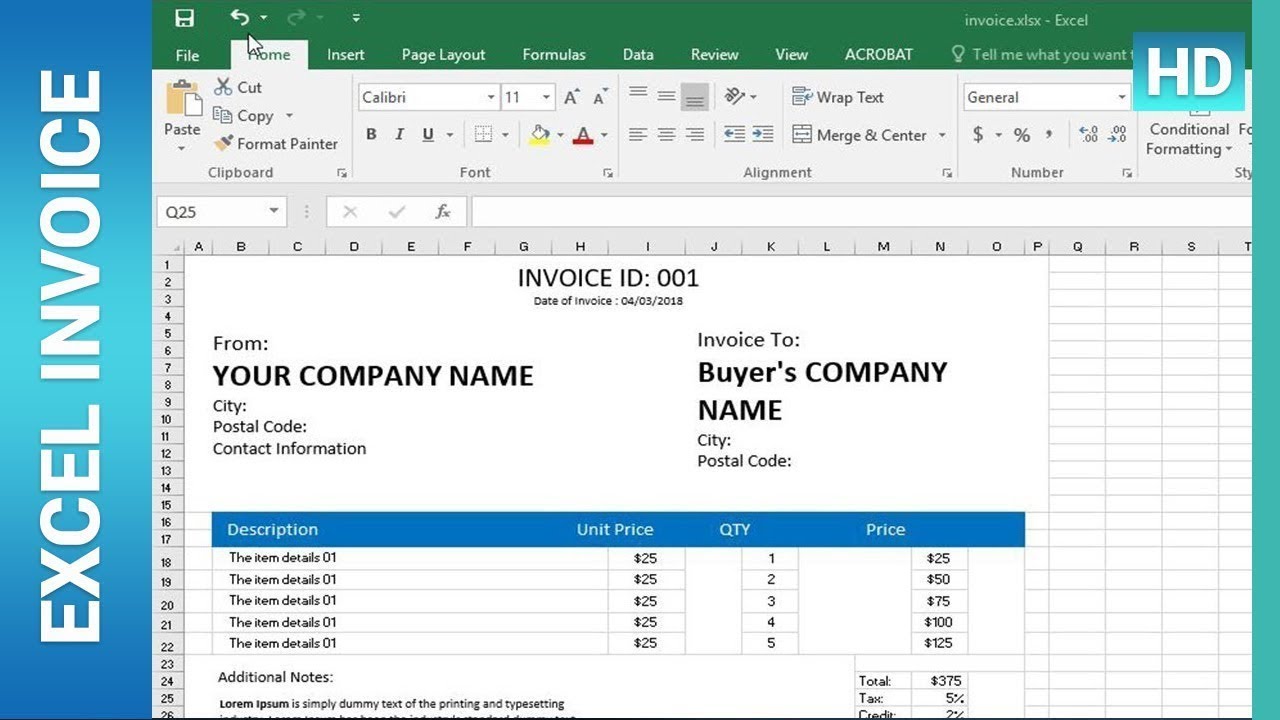

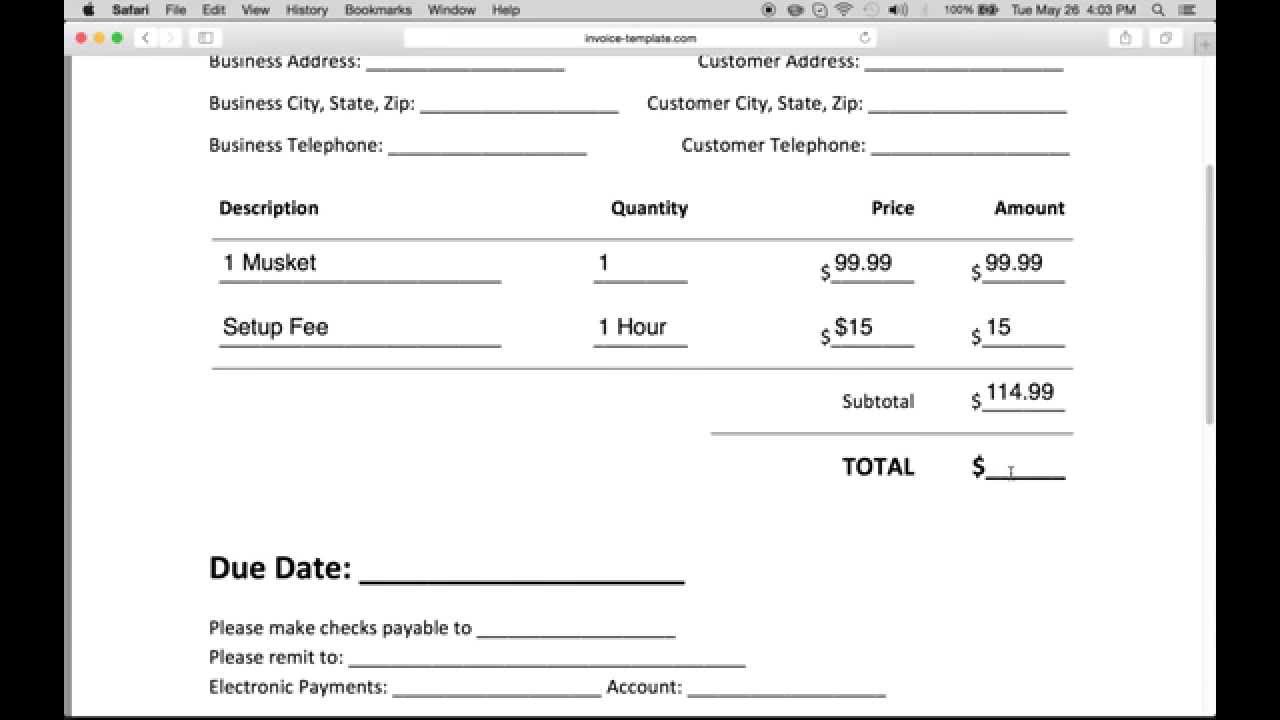

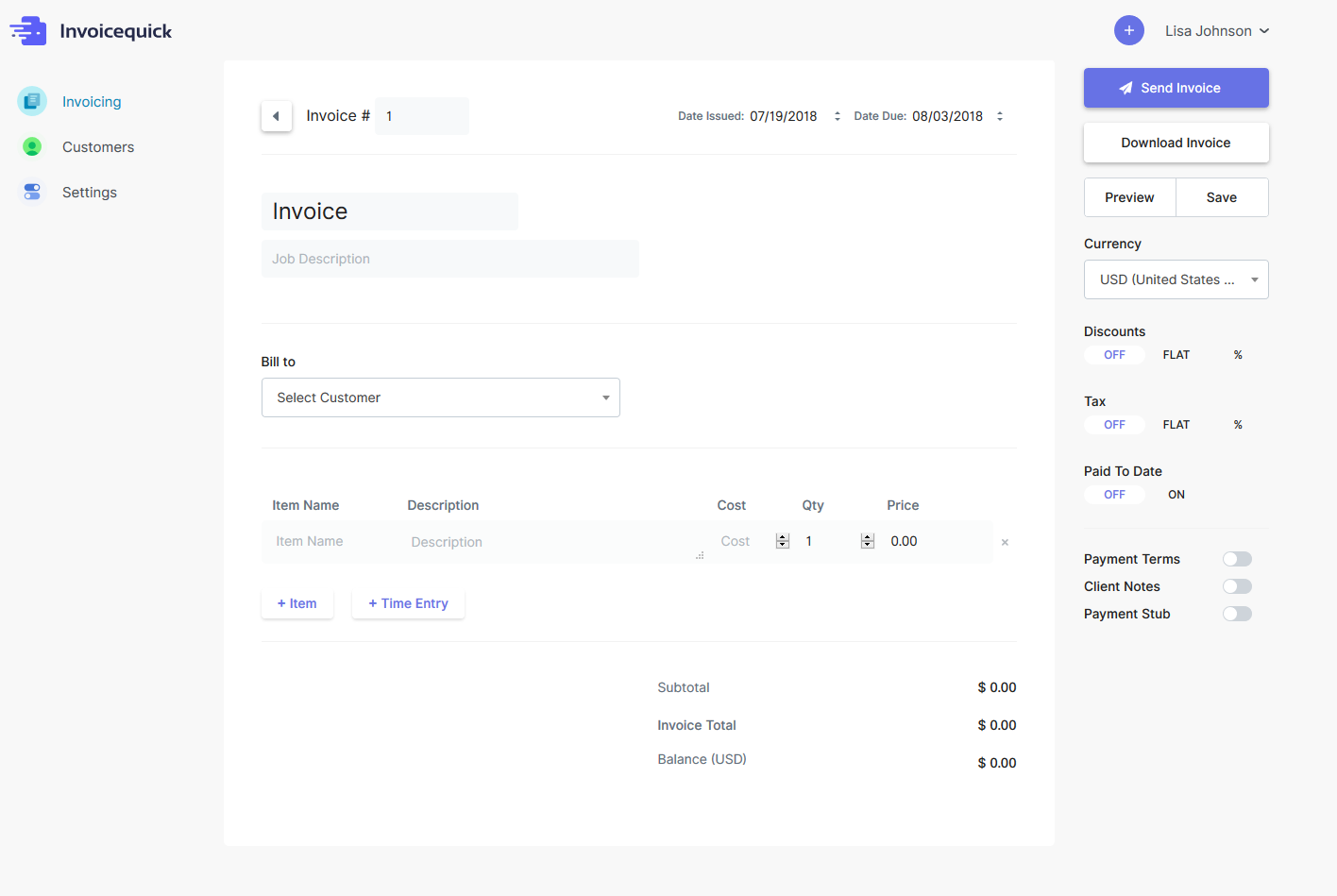

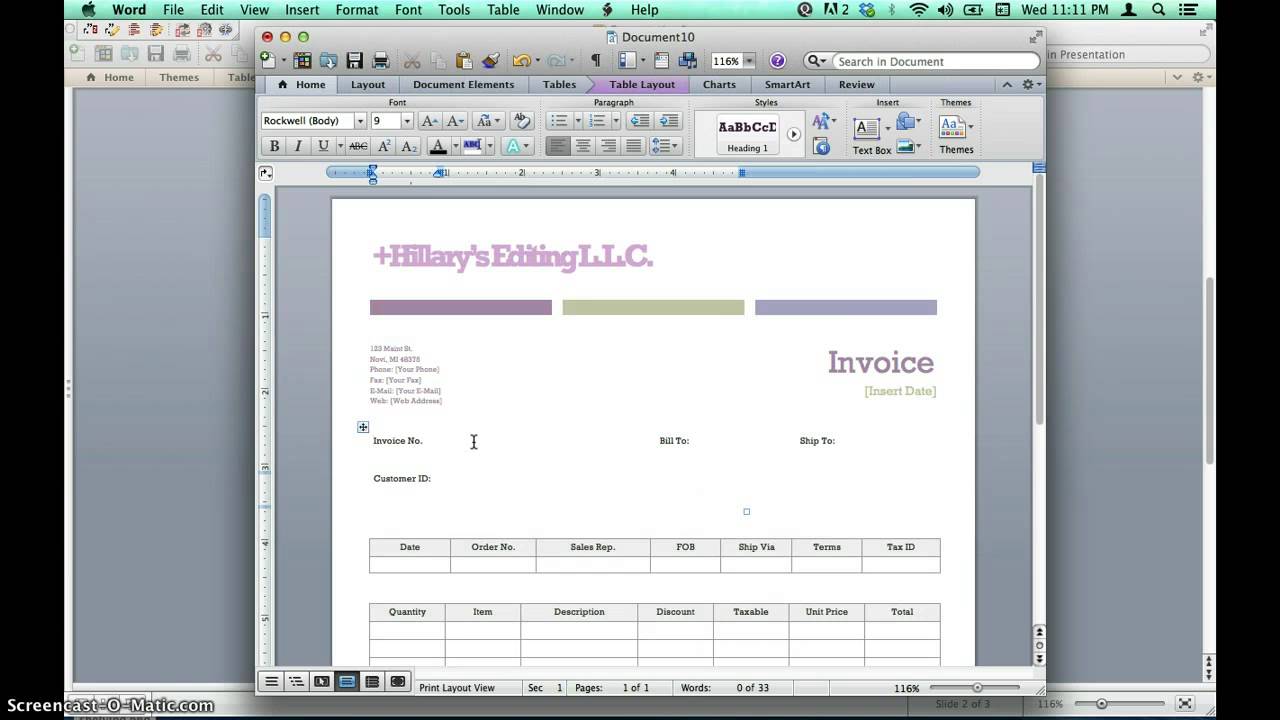

The trick to a terrific invoice is having a terrific template to begin with. A template or design templates that you use each time, removes lots of copying and pasting and fiddly formatting. Handwritten invoices are almost a thing of the past, so your options are to: create a Microsoft Word or Google doc utilize a spreadsheet with simple solutions that compute totals and taxes utilize a design template that features your invoicing or accounting software or you can utilize our complimentary design template If you're developing your invoices in a Word document or spreadsheet, conserve it as a PDF before sending out.

The 9-Minute Rule for Types Of Invoices

The 9-Minute Rule for Types Of Invoices

Things about Invoice Generator

Things about Invoice Generator

The Greatest Guide To Types Of Invoices

The Greatest Guide To Types Of Invoices

Without a doubt the most important aspect of invoicing is that you keep in mind to do it. That may sound absurd, but people forget all the time. Find a regular time that suits you to do your invoicing. That might be the end of the day or the end of the week.

Responsible For A Brand Budget? 10 Terrible Ways To Spend Your Money

Excitement About Invoice Generator

Table of ContentsInvoice Generator - The FactsThe Basic Principles Of Detailed Invoice Not known Facts About Mobile Invoice Maker AppThe Buzz on Detailed InvoiceNot known Incorrect Statements About Create Invoices About Invoicing Features

Getting The Invoice Maker To Work

Getting The Invoice Maker To Work

Not known Details About Detailed Invoice

Not known Details About Detailed Invoice

https://www.youtube.com/embed/cqkdhe6K5eM

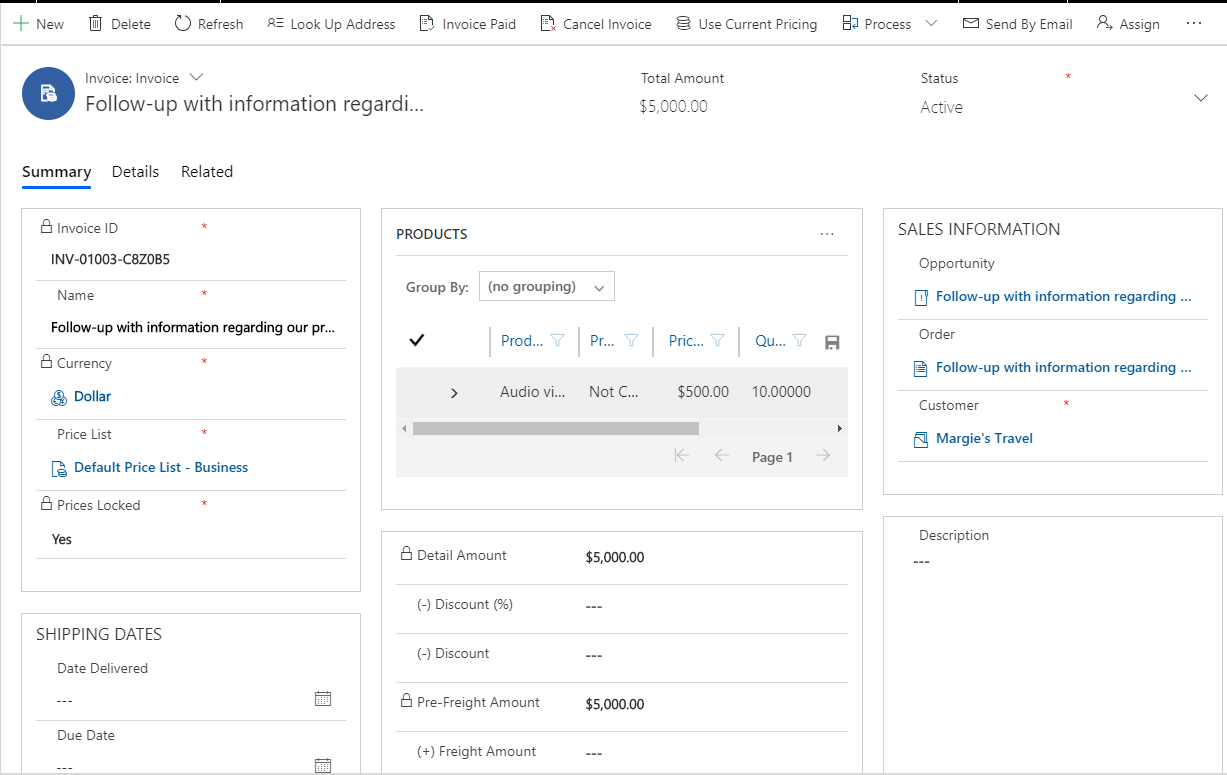

You can see the. Enter the and. Then select the date that the payment is due. 7. Click to give clients an option to leave a suggestion when paying the billing, as long as a service, class, or product has been contributed to it. Go into a message you desire to send out to the customer.

8. After examining the, click. 9. Once you click, you'll be taken to the primary page in your where you can see the invoice. If you click the 3 dots that correspond to it on the best side of the screen, you can do the following: Viewdetails of the invoice.

Void the item. Send a suggestion to the customer. This enables you to email a copy of the billing to the client. You can go into numerous receivers by separating each email address with a comma. The tip email will also consist of an option to. Inspect out the product and collect payment.

The Facts About Types Of Invoices Revealed

Rumored Buzz on Detailed Invoice

Rumored Buzz on Detailed Invoice

This action creates a copy of the invoice with a brand-new invoice number. The duplicate will be included to your. Export the billing to a PDF file. Print a paper copy. 1. Go to the main screen (-- > ). To look for a specific invoice, go into the,, the, or the employee who the product in the box at the top of the screen.

You can also look for a billing based upon the status. Click the drop-down to filter the search by,,, or. For circumstances, if you select, you can see all the invoices that are past due and past the due date. Let's have a look at each in more detail.

When you get to the primary page, locate an invoice that has a status. This is found on the best side of the screen. Click the three dots that correspond to it. As soon as you do this, you'll be able to do the following: Viewdetails of the invoice. Edit the billing.

How Detailed Invoice can Save You Time, Stress, and Money.

Send a tip to the customer. You'll have the ability to get in an e-mail and send out a copy of the invoice to the consumer. You can enter several receivers by separating each person's e-mail address by a comma. The suggestion email will also include a choice to. Have a look at the item and collect payment.

This action generates a copy of the billing with a brand-new invoice number. The replicate will be contributed to your. Export the invoice to a PDF file. Print a paper copy. These consist of invoices that you are still working on and have not been sent out to clients. When you get to the main page, locate a billing that has a status of, discovered on the ideal side of the screen.

When you do this, you'll have the ability to do the following: Viewdetails of the billing. Modify the billing. Delete the product. Develop a duplicate copy. This action creates a copy of the billing with a brand-new invoice number. The replicate will be added to your. Export the invoice to a PDF file.

Our Types Of Invoices Statements

These include invoices for which the customer has actually paid. As soon as you get to the primary page, find a billing that has the status, discovered on the best side of the screen. Then click the 3 dots that represent it. Once you do this, you'll have the ability to do the following: Viewdetails of the invoice.

This action creates a copy of the billing with a brand-new invoice number. The replicate will be contributed to your. Export the billing to a PDF file. Print a paper copy. If an invoice has actually been sent however it hasn't been paid, it will have a status billdu of The past due billings appear on the.

The Best Strategy To Use For Invoice Maker

The Best Strategy To Use For Invoice Maker

Once you get to the main page, find a billing that has a status of, discovered on the right side of the screen. Then click the 3 dots that represent it. As soon as you do this, you'll have the ability to do the following: Viewdetails of the billing. Edit the invoice.

The Greatest Guide To Mobile Invoice Maker App

Send a tip to the customer. You'll be able to go into an e-mail and send out a copy of the billing to the client. You can get in numerous receivers by separating everyone's email address by a comma. Have a look at the item and gather payment. Produce a duplicate copy. This action creates a copy of the invoice with a new invoice number.

Export the billing to a PDF file. Print a paper copy. These are invoices that have been canceled or removed. As soon as you get to the primary page, find a billing that has the status, discovered on the right side of the screen. Then click the 3 dots that represent it.

Export the invoice to a PDF file. Print a paper copy. 1. Click the bell icon at the top of the screen. 2. Under, click. This action takes you straight to the main page where you'll have the ability to see a list of invoices that are. 1.

Invoice Maker Can Be Fun For Everyone

2. Click the left side of the page. 3. Once you locate the deal, you'll find the column on the best side of the screen. Click a specific invoice amount to view more information. 4. Once you click the invoice amount, you'll have the ability to see details about the item.

5. If the invoice has been paid, you'll be able to view its information. 1. You can manage a worker's ability to view, include, modify, and delete in your account. To get to this page, follow these steps: Click at the top of the screen. Select on the left side of the screen.

Watch Out: How Google Docs Is Taking Over And What To Do About It

Invoicing Features - An Overview

Table of ContentsSome Known Facts About Invoice Maker.

A Biased View of Invoice Generator

A Biased View of Invoice Generator

Rumored Buzz on Invoice Generator

Rumored Buzz on Invoice Generator

https://www.youtube.com/embed/Fu15AuAWKKM

The secret to an excellent invoice is having a fantastic template to start with. A template or design templates that you utilize each time, eliminates lots of copying and pasting and fiddly formatting. Handwritten billings are practically a thing of the past, so your options are to: develop a Microsoft Word or Google doc utilize a spreadsheet with simple solutions that calculate totals and taxes utilize a template that features your invoicing or accounting software application or you can utilize our totally free design template If you're dashboard producing your billings in a Word document or spreadsheet, conserve it as a PDF before sending out.

Some Known Incorrect Statements About Types Of Invoices

Some Known Incorrect Statements About Types Of Invoices

A Biased View of Create Invoices

A Biased View of Create Invoices

The 5-Second Trick For Types Of Invoices

The 5-Second Trick For Types Of Invoices

By far the most crucial aspect of invoicing is that you remember to do it. That might sound outrageous, but people forget all the time. Find a routine time that suits you to do your invoicing. That may be completion of the day or completion of the week.

7 Things About Spark Invoice Maker You'll Kick Yourself For Not Knowing

All About Invoice Generator

Table of ContentsSome Ideas on Invoice Maker You Should KnowDetailed Invoice Things To Know Before You Get ThisDetailed Invoice Fundamentals ExplainedOur Invoicing Features DiariesInvoice Generator Fundamentals ExplainedWhat Does Invoice Generator Do?

https://www.youtube.com/embed/Pwc1zRd5AeU

Billings are a main component to the SimplePractice billing system. Developing a billing is the primary step for billing your customers. These documents show when there is a balance due for a customer - outlining the quantity they owe for services or items rendered. This guide covers how invoices will be used for optimized monetary management, giving you the tools you require to easily track customer balances.

There are numerous ways to develop billings. SimplePractice gives you the flexibility to manage these procedures automatically or manage them by hand as required. By default, invoices are set to immediately generate on a daily basis. With this setting, a billing will be created over night if a client has actually been seen for a consultation.

You also have the choice to by hand generate invoices or set them to auto-generate on a month-to-month basis. We recommend that these options are just utilized for practices with complex billing workflows. You can work with among our Consumer Success team to figure out if either of these choices are needed for your practice.

Getting The Invoice Maker To Work

Examine This Report about Invoice Generator

Examine This Report about Invoice Generator

When an invoice is produced, the quantity transfers to the, offering a record of what your client owes. You can handle your invoice generation settings by going to. From here you can select the option that is best for your practice: Automatically develop invoices at the end of every day.

Do not automate billings. (Only recommended for practices with complicated billing workflows) If you gather payment and record it at the time of a visit, you will include a payment and generate a billing at the same time from the Calendar Fly-out. To do this, select the correct consultation in the calendar.

The billing is generated and the payment applied. You'll receive verification of this with the invoice indicated on the flyout. If you 'd choose to view and personalize the invoice prior to using payment, you can click instead of. If you by hand develop invoices for a consultation, the system will not produce another replicate billing for that visit, even with automated invoicing established for your practice.

Create Invoices Things To Know Before You Buy

If you see either a or a quantity showed when it should not be, this indicates that you'll wish to upgrade their monetary records. Navigate to the client's page Click Click in the pop-up that follows Your billing will appear with all outstanding visits noted and you can modify it as required.

See How are payments assigned to billings? to find out about how your customer's payments are posted to billings. If your customers have charge change invoices, it means that the appointment charge has actually been changed for an appointment that was currently invoiced. If a consultation cost modifications, the system requires to develop a change invoice to balance out the change.

Facts About Mobile Invoice Maker App Revealed

Facts About Mobile Invoice Maker App Revealed

Modify the consultation fee, if you have not done so currently. If you have actually already modified the visit cost, skip to step 3. Produce new invoices for the consultation and ensure to edit the date prior to conserving the billing. You can modify the date on a recently developed invoice by clicking the date on the billing.

The Best Guide To Types Of Invoices

We recommend invoice automation due to the fact that billings are the basis of billing in SimplePractice. If you disable invoice automation, you will need to by hand invoice consultations for each customer. In your Billing and Providers settings, you can show when a billing is considered past due. This will assist you remain up to date with your billing and determine which invoices require your attention one of the most.

The Best Guide To Detailed Invoice

The Best Guide To Detailed Invoice

There isn't a method to prevent the system from suggesting billings after they've been provided for a certain number of days as past due. As soon as 30 days have passed given that a billing was produced, if it remains overdue, the status will alter to You can preview and tailor the past due e-mail design template by navigating to > > >.

See Adding a payment to find out how to include a client payment. are non-appointment products you can include to invoices to charge a client. It can include anything from books, workshops, service charges, an initial balance, etc. To find out more about establishing your product list, refer to. You can add an item as a line item to any unpaid billing.

Little Known Facts About Invoicing Features.

Create Invoices - The Facts

Create Invoices - The Facts

Open the overdue invoice. Click. If the invoice is currently marked as paid, you can delete it and recreate a brand-new one. New billings can be modified before they're conserved. Refer to to get more information. Click for the item you desire to add. You can include as numerous as you require.

After the product has actually been contributed to the invoice, you can make edits to the amount or description as required. The invoice is now all set to be paid. If you require to make any modifications, you can click once again at the top right corner as long as the invoice is in the status.

Excitement About Invoice Maker

Excitement About Invoice Maker

These billable, non-appointment products are contacted SimplePractice. In these cases, you can develop stand-alone billings to charge your customer for Products only. To get more information about how to include billable Products to your account, see Including an item. Browse to the client's page. Click >. Click. You will just see the popup if all existing appointments are currently invoiced.

Create Invoices - Questions

To learn how to create a new invoice for visits, see Creating invoices. Click. Click for each Item you want to add to the invoice. Click the when you're done. After the Product has been contributed to the invoice, you can make edits to the amount or description as needed.

This is why we've given you multiple choices for how services show on billings. To pick how you want to show this info by default, follow these actions: Go to Under choose either Usage Usage Consultation Service and Description By default, invoices will show all consultation types as when currencies the billing is created.

A Look Into The Future: What Will The Pdf Format Industry Look Like In 10 Years?

Invoice Generator Fundamentals Explained

Table of Contents4 Easy Facts About Detailed Invoice Explained

The Greatest Guide To Types Of Invoices

The Greatest Guide To Types Of Invoices

What Does Mobile Invoice Maker App Do?

What Does Mobile Invoice Maker App Do?

https://www.youtube.com/embed/JpbPRDUywQY

The trick to a terrific invoice is having a terrific design template to begin with. A template or templates that you use each time, removes lots of copying and pasting and fiddly format. Handwritten invoices are practically a distant memory, so your choices are to: develop a Microsoft Word or Google doc utilize a spreadsheet with basic solutions that compute overalls and taxes utilize a design template that comes with your invoicing or accounting software application or you can use our adobe pdf free design template If you're producing your invoices in a Word file or spreadsheet, wait as a PDF prior to sending.

Types Of Invoices Things To Know Before You Buy

Types Of Invoices Things To Know Before You Buy

Types Of Invoices Can Be Fun For Everyone

Types Of Invoices Can Be Fun For Everyone

Invoice Generator Can Be Fun For Anyone

Invoice Generator Can Be Fun For Anyone

By far the most essential feature of invoicing is that you remember to do it. That might sound ludicrous, but individuals forget all the time. Find a routine time that suits you to do your invoicing. That may be the end of the day or completion of the week.

20 Fun Facts About Credit Cards

An Unbiased View of Create Invoices

Table of ContentsAll About Invoicing FeaturesUnknown Facts About Create InvoicesThe smart Trick of Invoice Generator That Nobody is Talking AboutThe Basic Principles Of Invoice Generator The Greatest Guide To Invoicing Features6 Simple Techniques For Types Of Invoices

Unknown Facts About Types Of Invoices

Unknown Facts About Types Of Invoices

Everything about Invoicing Features

https://www.youtube.com/embed/P614aEhWTdk

You can see the. Get in the and. Then choose the date that the payment is due. 7. Click to provide customers a choice to leave a tip when paying the billing, as long as a service, class, or item has actually been included to it. Enter a message you wish to send out to the client.

8. After evaluating the, click. 9. Once you click, you'll be required to the primary page in your where you can view the invoice. If you click the three dots that represent it on the best side of the screen, you can do the following: Viewdetails of the invoice.

Void the item. Send out a suggestion to the client. This permits you to email a copy of the billing to the customer. You can go into several receivers by separating each e-mail address with a comma. The suggestion e-mail will likewise consist of an option to. Check out the product and collect payment.

Excitement About Mobile Invoice Maker App

The Basic Principles Of Create Invoices

The Basic Principles Of Create Invoices

This action creates a copy of the billing with a brand-new invoice number. The duplicate will be contributed to your. Export the invoice to a PDF file. Print a paper copy. 1. Go to the primary screen (-- > ). To look for a specific invoice, go into the,, the, or the worker who the item in package at the top of the screen.

You can likewise look for an invoice based upon the status. Click the drop-down to filter the search by,,, or. For circumstances, if you choose, you can see all the invoices that are overdue and past the due date. Let's take a look at each in more information.

As soon as you get to the main page, locate a billing that has a status. This is found on the ideal side of the screen. Click the three dots that represent it. Once you do this, you'll have the ability to do the following: Viewdetails of the billing. Modify the invoice.

The Definitive Guide to Create Invoices

Send out a reminder to the customer. You'll have the ability to enter an e-mail and send a copy of the invoice to the client. You can get in numerous recipients by separating each person's e-mail address by a comma. The reminder e-mail will likewise include a choice to. Have a look at the item and collect payment.

This action generates a copy of the invoice with a new invoice number. The replicate will be included to your. Export the invoice to a PDF file. Print a paper copy. These include billings that you are still working on and have actually not been sent out to clients. As soon as you get to the primary page, locate an invoice that has a status of, discovered on the ideal side of the screen.

As soon as you do this, you'll have the ability to do the following: Viewdetails of the billing. Edit the invoice. Delete the product. Create a replicate copy. This action produces a copy of the billing with a new billing number. The duplicate will be contributed to your. Export the billing to a PDF file.

Types Of Invoices - An Overview

These consist Spark Invoice Maker of invoices for which the customer has actually paid. Once you get to the primary page, locate a billing that has the status, discovered on the best side of the screen. Then click the 3 dots that represent it. When you do this, you'll be able to do the following: Viewdetails of the billing.

This action generates a copy of the invoice with a new invoice number. The duplicate will be contributed to your. Export the billing to a PDF file. Print a paper copy. If an invoice has been sent out however it hasn't been paid, it will have a status of The past due billings appear on the.

The Ultimate Guide To Create Invoices

The Ultimate Guide To Create Invoices

When you get to the main page, locate a billing that has a status of, discovered on the ideal side of the screen. Then click the 3 dots that correspond to it. When you do this, you'll be able to do the following: Viewdetails of the invoice. Edit the billing.

Invoice Generator Things To Know Before You Get This

Send out a tip to the client. You'll be able to enter an e-mail and send a copy of the billing to the consumer. You can go into multiple receivers by separating each person's e-mail address by a comma. Take a look at the product and gather payment. Develop a replicate copy. This action produces a copy of the invoice with a brand-new invoice number.

Export the billing to a PDF file. Print a paper copy. These are invoices that have been canceled or gotten rid of. As soon as you get to the primary page, find an invoice that has the status, found on the right side of the screen. Then click the 3 dots that correspond to it.

Export the billing to a PDF file. Print a paper copy. 1. Click the bell icon at the top of the screen. 2. Under, click. This action takes you straight to the primary page where you'll have the ability to see a list of invoices that are. 1.

Create Invoices Things To Know Before You Get This

2. Click on the left side of the page. 3. As soon as you find the deal, you'll discover the column on the right side of the screen. Click a particular invoice quantity to see more details. 4. Once you click the invoice amount, you'll be able to see information about the item.

5. If the invoice has actually been paid, you'll have the ability to see its information. 1. You can manage an employee's capability to see, add, modify, and erase in your account. To get to this page, follow these steps: Click at the top of the screen. Select on the left side of the screen.

Ask Me Anything: 10 Answers To Your Questions About 500k

The Invoice Generator Ideas

Table of ContentsThe smart Trick of Create Invoices That Nobody is Talking AboutThings about Mobile Invoice Maker AppOur Create Invoices DiariesSome Ideas on Invoice Maker You Need To KnowThe Main Principles Of Types Of Invoices

Invoice Maker for Dummies

Invoice Maker for Dummies

https://www.youtube.com/embed/YcuP249J2dE

Billings can be erased at any time! Here's how: Click the billing to view it. Once the billing is open, you'll see three buttons at the top of the screen: and, as shown listed below. Click. Deleted invoices and other erased documents can not be retrieved. Make certain to download the document as a PDF prior to deleting if you wish to keep it for your records.

They can remain in the system to suggest you've billed the customer. If billings aren't created for a session, the session fee will not be part of the client's balance and payments will lead to a credit balance. Yes, in order to utilize the billing features of SimplePractice, you'll need to utilize billings.

Many SimplePractice clients would like to include sales tax to their billings. While this is something that our program can not presently compute immediately, you can develop a Sales Tax "Product" which can be contributed to any invoice. First, go to and add a new item for Sales Tax with a description that works for you.

Excitement About Invoicing Features

Now return to your client's profile and produce an Invoice. Click to customize the billing and the button to enter your sales tax line product. Click to consist of the Sales Tax Item you created. Then click to return to the invoice. Next, compute and enter the appropriate quantity of the sales tax based upon the cost in the submitted and click at the top of the invoice.

Some clients decide to pass along the credit card processing fees to their clients. In some states this practice is illegal, so validate the laws that govern card approval in your state prior to you add fees to your credit billings. Here is how to include the processing charge to a customer invoice: That's it! Now your invoice consists of a charge card processing cost.

You can access and make a copy of it from here: Customers typically ask us for recommendations about the legality of this practice (i. e., passing charge card charges on to customers). The finest method to get a response to this question is to ask a legal representative. Nevertheless, we can provide some details that is extensively available on this problem.

The Basic Principles Of Invoice Maker

Please note that this is basic information only and we do not mean for you to use any of it as legal advice or guidance. Nor do we intend for you to use it in lieu pdf of looking for appropriate legal counsel. If you set the client's visit fee improperly or you choose to alter the cost for your client, you may require to erase and recreate invoices for these visits.

The invoice will show $100 due for the appointment. However, what if you meant to charge the customer $80 for this appointment? If you modify the consultation charge and alter it to $80, the billing will not automatically change to $100. The system believes you are making a modification so it develops a change billing with a $20 credit.

These additional invoices can be puzzling if you didn't suggest to bill that method. Let's stroll through the appropriate steps, which will leave you with a cleaner billing page. For the appointment that isn't billed properly you can pick one of 2 alternatives:. You are fixing the billing due to the fact that it reveals the incorrect charge and you only intend to bill the customer $80 (this is the most typical situation): Navigate to the customer's billing overview page, and click the invoice noted beside the visit in the appointment line and click in the leading right corner.

Get This Report on Invoice Generator

Click under the visit charge. Update the appointment charge (from $100 to $80). Click. Then develop a brand-new invoice for the client. You wish to produce a modification invoice and you don't wish to erase the initial billing. In this case, you can edit the consultation charge and let the system produce the modification invoice.

Click under the consultation charge. Enter the updated visit cost and click. The system will immediately produce a modification invoice. If you have billings set to be produced instantly, this change invoice will be produced over night. Otherwise, you can create it by hand by clicking from the upper right corner of the customer's profile.

We suggest keeping billings automation on Daily in order to prevent any billing confusion. Just make certain to make any session charge changes prior to the end of the day so invoices generate properly.

How Invoice Maker can Save You Time, Stress, and Money.

You've done the work; now it's payment time. Here's where your billing plays a key function. Let's walk through the procedure of making a billing. Before preparing a billing, make sure your client is expecting one. If your invoice comes out of no place, they may be slow to pay it, and even upset.

If you don't have an arrangement in place, at least tell them when a billing is about to be raised. You need to show the seller, the purchaser, and what was exchanged. You might likewise be required to show if you gathered tax on the sale. Some of the details, such as your business name, will stay the exact same from one billing to the next.

The Greatest Guide To Create Invoices

The Greatest Guide To Create Invoices

You require to have a distinct billing number on every costs you send out. This is to assist you, the client, or potentially auditors to track down particular invoices. A billing number can be any string of numbers and letters. You can utilize different techniques to produce a billing number, such as: numbering your invoices sequentially, for instance INV00001, INV00002 beginning with a special consumer code, for example XER00001 consisting of the date at the start of your billing number, for instance 2019-01-001 integrating the consumer code and date, for instance XER-2019-01-001 Your numbering system can assist you arrange and look for past billings rapidly.

11 Ways To Completely Revamp Your Spark

Top Guidelines Of Invoice Generator

Table of ContentsSome Known Details About Invoice Generator

Some Known Incorrect Statements About Invoicing Features

Some Known Incorrect Statements About Invoicing Features

The Facts About Detailed Invoice Revealed

The Facts About Detailed Invoice Revealed

https://www.youtube.com/embed/eyduFYFeUGc

The secret to a terrific billing is having an excellent template to start with. A template or templates that you use each time, eliminates great deals of copying and pasting and fiddly formatting. Handwritten billings are almost a thing of the past, so your options are to: create a Microsoft Word or Google doc utilize a spreadsheet with easy solutions that determine totals and taxes utilize a template that comes with your invoicing or accounting software or you can use our totally free template If you're producing your billings in a Word file or spreadsheet, save it as a PDF before sending out.

The smart Trick of Invoice Generator That Nobody is Talking About

The smart Trick of Invoice Generator That Nobody is Talking About

Not known Details About Detailed Invoice

By far the most essential thing about invoicing is that you keep in mind to do it. That may sound ludicrous, however individuals forget all the time. Discover a routine time that suits you to do your invoicing. payment That might be the end of the day or completion of the week.

The Urban Dictionary Of Credit Cards

7 Easy Facts About Invoice Maker Explained

Table of ContentsInvoice Generator Things To Know Before You Get ThisNot known Incorrect Statements About Invoice Maker The Only Guide to Types Of InvoicesFacts About Invoice Generator RevealedThe Ultimate Guide To Types Of Invoices

Some Known Incorrect Statements About Invoice Generator

Some Known Incorrect Statements About Invoice Generator

https://www.youtube.com/embed/AmbMokK-Fqc

Invoices can be erased at any time! Here's how: Click the invoice to view it. Once the invoice is open, you'll see three buttons at the top of the screen: and, as revealed listed below. Click. Deleted billings and other erased documents can not be recovered. Ensure to download the file as a PDF before erasing if you wish to keep it for your records.

They can stay in the system to suggest you've billed the client. If billings aren't created for a session, the session cost will not become part of the customer's balance and payments will lead to a credit balance. Yes, in order to use the billing features of SimplePractice, you'll require to use billings.

Numerous SimplePractice clients want to add sales tax to their invoices. While this is something that our program can not currently determine immediately, you can create a Sales Tax "Product" which can be added to any billing. Initially, go to and include a brand-new item for Sales Tax with a description that works for you.

Not known Incorrect Statements About Create Invoices

Now go back tool to your customer's profile and produce a Billing. Click to tailor the billing and the button to enter your sales tax line product. Click to consist of the Sales Tax Product you developed. Then click to go back to the billing. Next, calculate and enter the suitable amount of the sales tax based on the cost in the filed and click at the top of the billing.

Some clients decide to pass along the credit card processing costs to their customers. In some states this practice is illegal, so validate the laws that govern card acceptance in your state before you add costs to your credit invoices. Here is how to include the processing cost to a customer invoice: That's it! Now your invoice consists of a charge card processing charge.

You can access and make a copy of it from here: Customers often ask us for recommendations about the legality of this practice (i. e., passing charge card fees on to clients). The very best way to get an answer to this question is to ask an attorney. However, we can supply some information that is widely offered on this concern.

Types Of Invoices Things To Know Before You Get This

Please keep in mind that this is general details just and we do not plan for you to utilize any of it as legal suggestions or assistance. Nor do we mean for you to utilize it in lieu of seeking suitable legal counsel. If you set the customer's appointment cost incorrectly or you decide to alter the cost for your client, you may require to erase and recreate invoices for these visits.

The invoice will display $100 due for the consultation. But, what if you indicated to charge the customer $80 for this consultation? If you edit the consultation charge and alter it to $80, the billing won't automatically change to $100. The system believes you are making an adjustment so it produces a modification invoice with a $20 credit.

These additional invoices can be puzzling if you didn't imply to expense that way. Let's stroll through the correct steps, which will leave you with a cleaner billing page. For the visit that isn't billed correctly you can select one of two options:. You are remedying the invoice because it reveals the inaccurate cost and you only intend to bill the customer $80 (this is the most typical circumstance): Browse to the customer's billing summary page, and click the invoice noted next to the appointment in the consultation line and click in the top right corner.

Excitement About Types Of Invoices

Click under the visit charge. Update the appointment charge (from $100 to $80). Click. Then produce a new billing for the client. You want to develop a change billing and you do not wish to erase the original invoice. In this case, you can edit the appointment charge and let the system create the change billing.

Click under the appointment charge. Get in the updated consultation charge and click. The system will instantly produce a change invoice. If you have billings set to be developed immediately, this modification invoice will be produced over night. Otherwise, you can produce it by hand by clicking from the upper right corner of the customer's profile.

We suggest keeping invoices automation on Daily in order to avoid any billing confusion. Just make certain to make any session charge changes prior to the end of the day so invoices produce correctly.

Not known Facts About Detailed Invoice

You have actually done the work; now it's payment time. Here's where your invoice plays a key function. Let's walk through the process of making an invoice. Prior to preparing a billing, ensure your consumer is expecting one. If your billing comes out of nowhere, they might be slow to pay it, or even upset.

If you don't have a contract in location, a minimum of tell them when an invoice will be raised. You need to reveal the seller, the purchaser, and what was exchanged. You may likewise be needed to show if you collected tax on the sale. Some of the details, such as your service name, will stay the very same from one invoice to the next.

Some Known Questions About Invoice Generator.

Some Known Questions About Invoice Generator.

You require to have an unique billing number on every costs you send out. This is to help you, the customer, or potentially auditors to locate particular billings. A billing number can be any string of numbers and letters. You can use different techniques to create a billing number, such as: numbering your billings sequentially, for example INV00001, INV00002 beginning with an unique consumer code, for instance XER00001 consisting of the date at the start of your invoice number, for instance 2019-01-001 combining the client code and date, for instance XER-2019-01-001 Your numbering system can assist you arrange and browse for past billings rapidly.

Addicted To Sales Tax? Us Too. 6 Reasons We Just Can't Stop

10 Simple Techniques For Mobile Invoice Maker App

Table of ContentsInvoice Generator Fundamentals ExplainedAn Unbiased View of Detailed InvoiceThe 15-Second Trick For Invoicing Features7 Simple Techniques For Invoice MakerInvoice Generator Can Be Fun For AnyoneInvoice Generator Things To Know Before You Get This

Some Known Facts About Invoice Generator.

Some Known Facts About Invoice Generator.

The Greatest Guide To Detailed Invoice

The Greatest Guide To Detailed Invoice

https://www.youtube.com/embed/bntwuLoRuEo

You can see the. Go into the and. Then select the date that the payment is due. 7. Click to give clients an option to leave a tip when paying the invoice, as long as a service, class, or product has actually been added to it. Get in a message you wish to send out to the customer.

8. After reviewing the, click. 9. When you click, you'll be required to the primary page in your where you can see the billing. If you click the three dots that correspond to it on the right side of the screen, you can do the following: Viewdetails of the invoice.

Void the product. Send a reminder to the customer. This enables you to email a copy of the invoice to the client. You can get in multiple recipients by separating each email address with a comma. The suggestion e-mail will likewise consist of an alternative to. Take a look at the product and collect payment.

4 Simple Techniques For Create Invoices

The smart Trick of Mobile Invoice Maker App That Nobody is Discussing

The smart Trick of Mobile Invoice Maker App That Nobody is Discussing

This action creates a copy of the billing with a brand-new billing number. The duplicate will be contributed to your. Export the billing to a PDF file. Print a paper copy. 1. Go to the information primary screen (-- > ). To browse for a specific invoice, go into the,, the, or the staff member who the item in the box at the top of the screen.

You can likewise browse for an invoice based on the status. Click the drop-down to filter the search by,,, or. For example, if you choose, you can see all the billings that are past due and past the due date. Let's take a look at each in more detail.

As soon as you get to the primary page, locate a billing that has a status. This is discovered on the ideal side of the screen. Click the three dots that correspond to it. As soon as you do this, you'll have the ability to do the following: Viewdetails of the billing. Modify the invoice.

Not known Incorrect Statements About Invoice Maker

Send a reminder to the customer. You'll have the ability to go into an email and send out a copy of the invoice to the customer. You can go into several receivers by separating each individual's e-mail address by a comma. The reminder e-mail will likewise include an option to. Have a look at the product and collect payment.

This action creates a copy of the billing with a brand-new invoice number. The replicate will be contributed to your. Export the billing to a PDF file. Print a paper copy. These include billings that you are still working on and have not been sent to clients. Once you get to the primary page, locate a billing that has a status of, found on the right side of the screen.

Once you do this, you'll have the ability to do the following: Viewdetails of the invoice. Modify the invoice. Delete the item. Produce a duplicate copy. This action creates a copy of the billing with a brand-new billing number. The replicate will be contributed to your. Export the billing to a PDF file.

The 45-Second Trick For Types Of Invoices

These consist of invoices for which the consumer has actually paid. As soon as you get to the primary page, locate a billing that has the status, discovered on the right side of the screen. Then click the three dots that represent it. As soon as you do this, you'll be able to do the following: Viewdetails of the invoice.

This action generates a copy of the invoice with a brand-new billing number. The duplicate will be contributed to your. Export the invoice to a PDF file. Print a paper copy. If a billing has been sent but it hasn't been paid, it will have a status of The overdue invoices appear on the.

Some Ideas on Create Invoices You Need To Know

Some Ideas on Create Invoices You Need To Know

When you get to the main page, find a billing that has a status of, found on the best side of the screen. Then click the 3 dots that correspond to it. As soon as you do this, you'll be able to do the following: Viewdetails of the billing. Modify the billing.

The 25-Second Trick For Invoicing Features

Send out a tip to the client. You'll have the ability to go into an e-mail and send out a copy of the billing to the customer. You can enter numerous recipients by separating each person's email address by a comma. Take a look at the item and gather payment. Develop a replicate copy. This action creates a copy of the invoice with a new invoice number.

Export the billing to a PDF file. Print a paper copy. These are invoices that have been canceled or gotten rid of. When you get to the main page, find an invoice that has the status, found on the right side of the screen. Then click the three dots that represent it.

Export the billing to a PDF file. Print a paper copy. 1. Click the bell icon at the top of the screen. 2. Under, click. This action takes you straight to the primary page where you'll have the ability to see a list of invoices that are. 1.

See This Report about Detailed Invoice

2. Click the left side of the page. 3. When you locate the deal, you'll discover the column on the best side of the screen. Click a particular invoice amount to see more details. 4. As soon as you click the invoice amount, you'll be able to see details about the item.

5. If the invoice has actually been paid, you'll be able to see its information. 1. You can manage a worker's ability to view, include, edit, and erase in your account. To get to this page, follow these actions: Click at the top of the screen. Select on the left side of the screen.